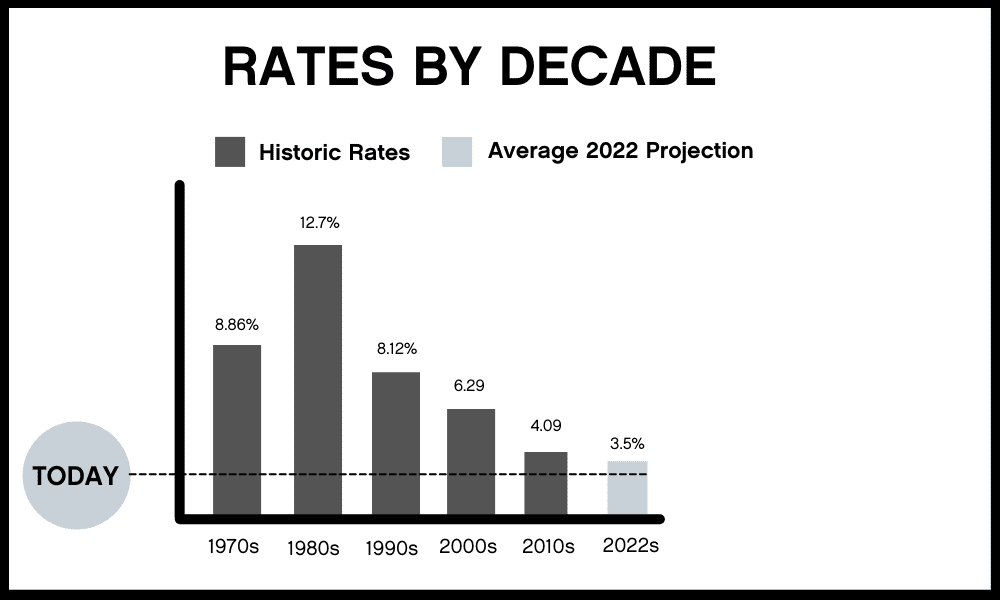

Mortgage Rates May Rise in 2022

Home mortgage rates may be rising but they are still historically low. This means, despite it being a seller’s market there are still benefits to buying a home now. Housing market experts such as Fannie Mae and NAR (National Association of Realtors) are very credible resources when it comes to predicting home loan rates. In this fast paced home market, it’s important to consider rates predicted by credible sources, but always consider the NOW. The now is: Mortgage Rates are still historically great for home buyers.

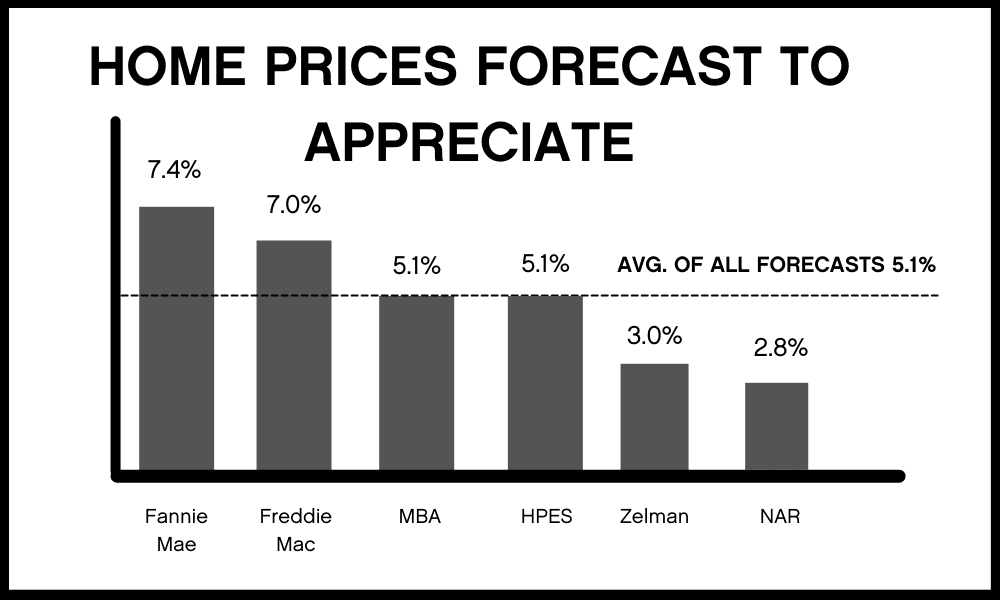

Varying Predictions on Home Appreciation

The 2022 housing market predictions from experts vary as far as what the home price appreciation will look like this year. Nonetheless, it is unanimous in that home values will continue rise, whether by 7.4% or 2.8%. If you are looking to buy a home, you may want to consider buying a home sooner rather than later to avoid the continued appreciation value. There are many factors that affect home sale price such as location, interest rates, and home improvements. On average, home values are appreciating, but that doesn’t mean you can’t still find the dream home that is in your budget and meets your unique needs.

Young Team Owner, Ryan Young: Spring Housing Market Predictions:

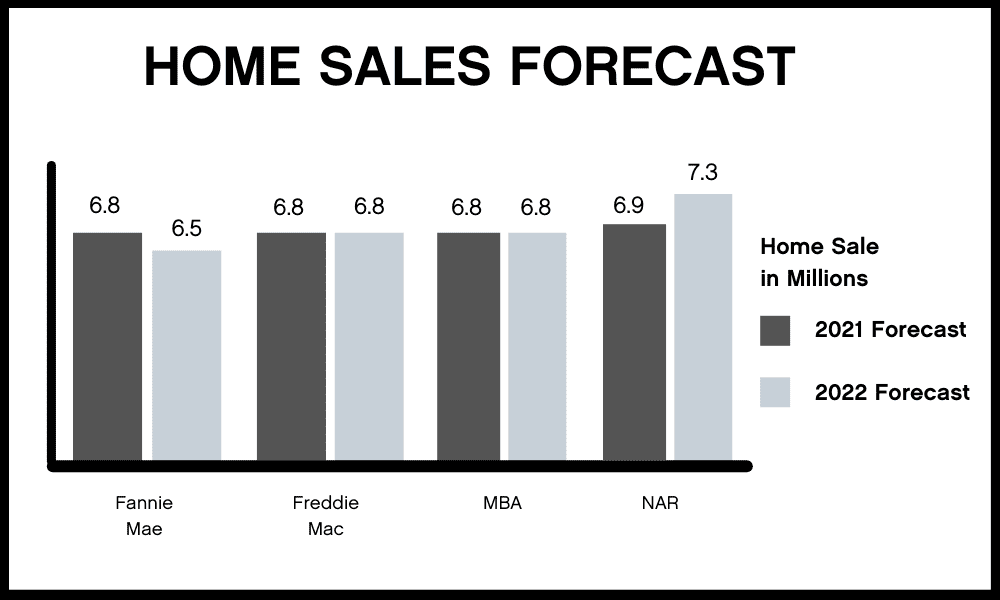

2022 Home Sale Forecast Predicted to Remain Strong

As more people move to meet their changing needs, it is predicted by experts that the number of homes sold this year will be between 6.8-7.3 million. Compared to last year, the home sale forecast is very similar.

Are you ready to buy your next home? Even if you’re not a first time home buyer, there are many factors to consider and it can be confusing. Not to worry, The Young Team is here to help answer all of your real estate questions.

Sources: Keeping Current Matters, Fannie Mae, Freddie Mac, MBA, NAR, Pulsenomics, Zelman