How to save money in a high interest rate market.

In today’s real estate market, the 3-2-1 buydown mortgage can make homeownership more accessible to current buyers. This strategy paves a way for a more affordable and financially viable home buying experience for everyone involved.

In this post we’re going to breakdown this mortgage strategy to understand all the benefits and how to apply to these types of options when buying, especially if you’re a first time homebuyer:

What is a 3-2-1 Interest Rate Buydown?

A 3-2-1 interest rate buydown is a mortgage financing option where the buyer receives a temporary reduction in the interest rate for the initial years of the loan. It follows a structured pattern: the interest rate is reduced by 3% in the first year, 2% in the second year, and 1% in the third year, after which it stabilizes at the original rate for the remainder of the term.

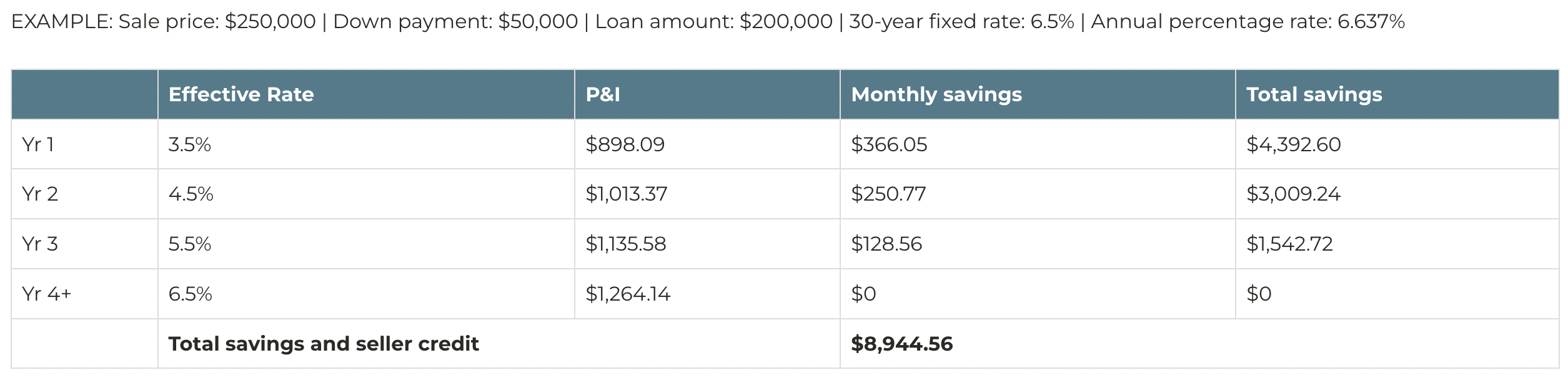

Our mortgage partners at Cross Country Mortgage explain it very well in the following example:

How Does a 3-2-1 Buydown Work?

The mechanics of a 3-2-1 buydown are straightforward. The seller or builder contributes upfront to temporarily subsidize the buyer’s monthly mortgage payments during the initial years. This strategy can be advantageous for various stakeholders in the real estate market.

As per Investopedia.com, Builders or sellers may offer this buydown option to enhance the affordability of the property and increase the likelihood of a successful sale.

Who is eligible for this option:

People who are purchasing a home or refinancing an existing mortgage may be eligible for a 3-2-1 buydown. However, eligibility may vary depending on the lender and the specific loan program being used.

In conversation with Christopher Bullock, Loan Originator for Cross Country Mortgage, this option is the most appropriate if you are a first time home buyer, since you can amortize the high interest rate in the actual real estate market, helping you to save money in the monthly payment of your mortgage.

Other types of temporary Buydown:

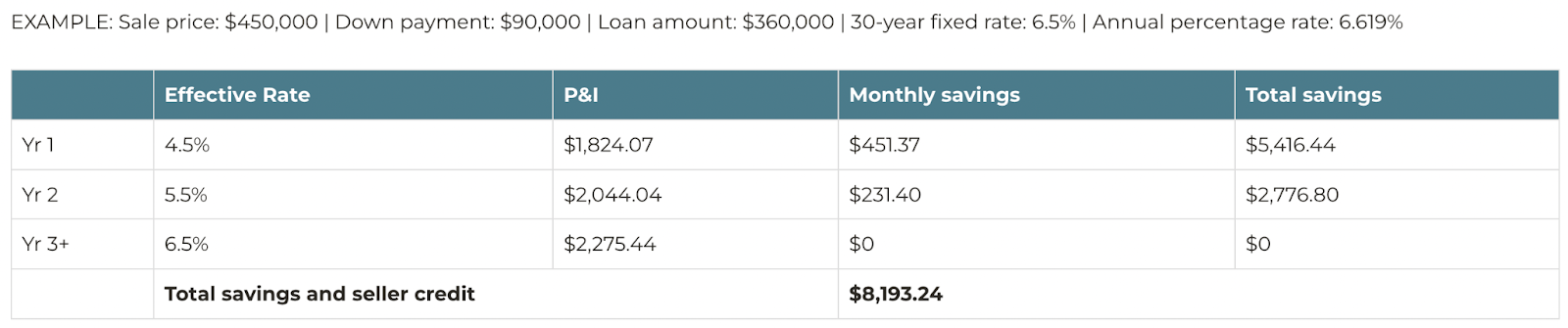

Christopher walked us through the 2-1 Buydown, that in essence is the temporary reduction of the buyer’s interest rate by 2% for the first year of their loan and 1% for the second year.

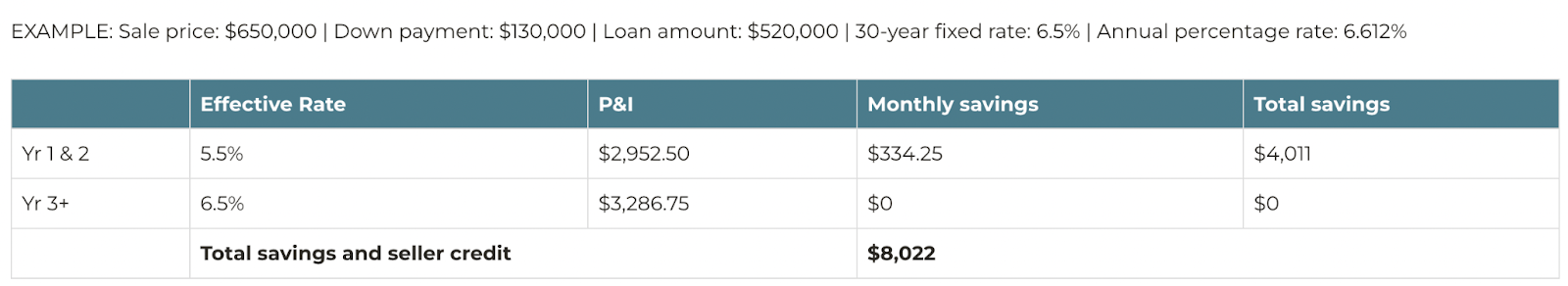

Also, the 1-1 Temporary Buydown reduces the buyer’s interest rate by 1% for the first two years of their loan.

Pros and Cons of Interest Rate Buydown:

- Good for Buyers, Sellers, and Builders: Provides a mutually beneficial arrangement by making homeownership more attainable for buyers while helping sellers and builders expedite property sales.

- For Sellers Considering a Price Cut: Offers a compelling alternative to lowering the home’s sale price, making it an enticing option to captivate potential buyers while preserving the perceived value of the property.

- Savings for the Buyer without Lowering the Sale Price: Enables buyers to enjoy immediate monthly payment savings without negotiating the purchase price.

- For Builders Who Want to Move Inventory: Facilitates faster turnover of properties for builders looking to reduce inventory and streamline their operations.

- An Alternative Incentive: Serves as an innovative incentive that sets the property apart from others in the competitive market.

- For Buyers Stretching Their Dollars: Allows buyers to maximize their purchasing power, particularly beneficial for those seeking more expensive properties within their budget constraints.

- Immediate Monthly Payment Savings: Provides tangible financial relief by reducing the initial mortgage payments, freeing up funds that can be allocated elsewhere.

- Savings for 1, 2, or 3 Years: Offers flexible savings for a defined period, allowing buyers to plan their finances accordingly.

- A Locked Rate If Rates Increase: Protects the buyer from potential interest rate hikes during the initial years of the mortgage term.

- Room to Refinance If Rates Fall: Presents an opportunity for refinancing if market rates decrease, enabling borrowers to capitalize on lower interest rates after the initial buydown period.

Final Takeaway:

In essence, the 3-2-1 buydown mortgage presents a strategic tool that benefits both buyers and sellers, providing a win-win solution in the dynamic landscape of the real estate market.

Expert Tip: Don to take into account both the up-front costs of buying a home, like the down payment or closing costs, and the ongoing expenses to get an idea of what you can afford as a homeowner. Learn more here!

Are you considering a 3-2-1 buydown as a mortgage financing strategy? Our team of experts can assist you in assessing whether a buydown aligns with your individual financial circumstances.

Let us show you the way to make the perfect investment for your financial goals.

More References:

Learn more about types of mortgages in our Blog

Think twice before waiting for 3% interest rates in ohio

Read more than 1,000 5-star experiences on Google that have certified

The Young Team as Cleveland’s #1 trusted real estate team!

Reach out to us today and find your perfect home!

- Disclaimer: The sample rates provided are for illustration purposes only and are not intended to provide mortgage or other financial advice specific to the circumstances of any individual and should not be relied upon in that regard. CrossCountry Mortgage, LLC cannot predict where rates will be in the future. The payment example does not include assessments. Actual payment obligations may be greater and may vary. Mortgage Insurance Premium (MIP) is required for all FHA loans and Private Mortgage Insurance (PMI) is required for all conventional loans where the LTV is greater than 80%. Rate(s), APR(s) and payment info is valid as of 12/14/2022 and assumes a first lien position, 740 FICO score, 25-day rate lock, based on a single-family home. All terms are subject to change without notice. Loans are subject to underwriting guidelines and the applicant’s credit profiles, not all applicants will receive approval. Contact CrossCountry Mortgage, LLC for more information. Available for conventional, FHA, VA, and USDA loans only. Equal Housing Opportunity. All loans subject to underwriting approval. Certain restrictions apply. ↩︎

- Disclaimer: The sample rates provided are for illustration purposes only and are not intended to provide mortgage or other financial advice specific to the circumstances of any individual and should not be relied upon in that regard. CrossCountry Mortgage, LLC cannot predict where rates will be in the future. The payment example does not include assessments. Actual payment obligations may be greater and may vary. Mortgage Insurance Premium (MIP) is required for all FHA loans and Private Mortgage Insurance (PMI) is required for all conventional loans where the LTV is greater than 80%. Rate(s), APR(s) and payment info is valid as of 12/14/2022 and assumes a first lien position, 740 FICO score, 25-day rate lock, based on a single-family home. All terms are subject to change without notice. Loans are subject to underwriting guidelines and the applicant’s credit profiles, not all applicants will receive approval. Contact CrossCountry Mortgage, LLC for more information. Available for conventional, FHA, VA, and USDA loans only. Equal Housing Opportunity. All loans subject to underwriting approval. Certain restrictions apply. ↩︎

- Disclaimer: The sample rates provided are for illustration purposes only and are not intended to provide mortgage or other financial advice specific to the circumstances of any individual and should not be relied upon in that regard. CrossCountry Mortgage, LLC cannot predict where rates will be in the future. The payment example does not include assessments. Actual payment obligations may be greater and may vary. Mortgage Insurance Premium (MIP) is required for all FHA loans and Private Mortgage Insurance (PMI) is required for all conventional loans where the LTV is greater than 80%. Rate(s), APR(s) and payment info is valid as of 12/14/2022 and assumes a first lien position, 740 FICO score, 25-day rate lock, based on a single-family home. All terms are subject to change without notice. Loans are subject to underwriting guidelines and the applicant’s credit profiles, not all applicants will receive approval. Contact CrossCountry Mortgage, LLC for more information. Available for conventional, FHA, VA, and USDA loans only. Equal Housing Opportunity. All loans subject to underwriting approval. Certain restrictions apply. ↩︎